Moody’s is uniquely positioned to provide entity data for institutions and/or intermediaries as well as individual risk screening requirements throughout the lifecycle of a business relationship.

From financial data to PEPs, sanctions, and adverse media screening to individual ID verification. We can integrate any data checks into an automated compliance workflow. Use a complete compliance platform, designed around your business.

Optimize AML and KYC processes. Digitize risk policies. Update your client journeys and any compliance workflows when you need to.

Investors, clients, and intermediaries KYC lifecycle

Asset management

Unlock operational efficiencies while strengthening client and investor relationships with automated onboarding and risk monitoring from Moody’s.

As know your customer (KYC) and anti-money laundering (AML) regulatory requirements expand, make the most of your resources. Digitally transform your end-to-end risk and compliance processes and overcome core data gaps.

A smarter way to handle investors, clients, and intermediaries throughout the KYC lifecycle.

- Reduce cost per trade

- Minimize cost to serve

- Enhance client/investor experiences

Digitally transform compliance

KYC solutions for Asset Managers

Build an entire compliance journey in-line with your risk policy and integrate any number of data checks. With smart policies you can update, edit, and change your journeys whenever you need. Learn what drives the best results for you, and the best experiences for clients and investors.

Integrate accurate, comprehensive data and screening checks into your unique compliance workflow. Moody’s offers pre-built integrations for UBO discovery, PEPs, sanctions, adverse media screening, and entity data and individual ID checks.

We help maximize straight-through processing, bringing people into the compliance process where they are needed for enhanced due diligence or decision making. Control onboarding and risk monitoring from one secure, online platform. View risk profiles, escalate issues, and keep processes moving.

Collect information directly from clients and investors via a single compliance platform. Use custom forms to enhance your investor/client experiences – send requests and capture missing or additional data from the platform. With documents assigned to profiles and forms dynamically interacting with your smart policies, cut down onboarding times and create better experiences.

Maintain risk data and decision records in one place to respond to audit requests quickly and efficiently. The data we provide is of the highest quality, detailed, and able to satisfy your regulatory requirements and audit requests. A history of actions and outcomes can be shown in a responsive and simple way.

Compliance efficiency with great experiences

Benefits for Asset Managers

Protect your margins and gain competitive advantage by improving operational efficiencies around AML and other compliance processes. Manage the growing volume of regulatory requirements, improve time to revenue, and transform client and investor experiences.

Moody’s KYC solutions help Asset Managers reduce onboarding times, automate manual tasks, and simplify complex compliance activity. Optimize AML and KYC processes, digitize risk policies, and update your configuration with you need.

Create compliance efficiency and great client experiences - no compromise. Get in touch to find out more about our digital CLM solutions.

Supporting sanctions compliance

Four types of sanctions compliance

Moody’s can also support sanctions compliance related to investors, clients, and intermediaries. Here are four ways we can help with sanctions compliance throughout the lifecycle of a relationship. Act quickly and decisively with access to accurate, real-time data.

Sanctions lists

Ensure coverage of all the major sanctions watchlists around the world. Receive updates every 24 hours. Feel safe in the knowledge you are always using the most recent sanctions lists.

Ownership or control

Not all sanctioned entities are named on lists. Analyze ownership, control, voting power, and linkages to stay compliant with laws like OFACs 50% and the EU’s “by control” rules.

Changing sanctions

Governments can place new sanctions and restrictions quickly. Make sure you’re ready to respond and ensure you always know your client/investor and supply chain risk exposure.

Cautionary

Sanctioned entities and individuals can operate via family members, friends, or other networks. Ensure you can identify associations below ownership thresholds, as well as checking familial and personal relationships or sanctioned individuals.

Here's just one example of why it's important to go beyond the sanctions lists to uncover risk

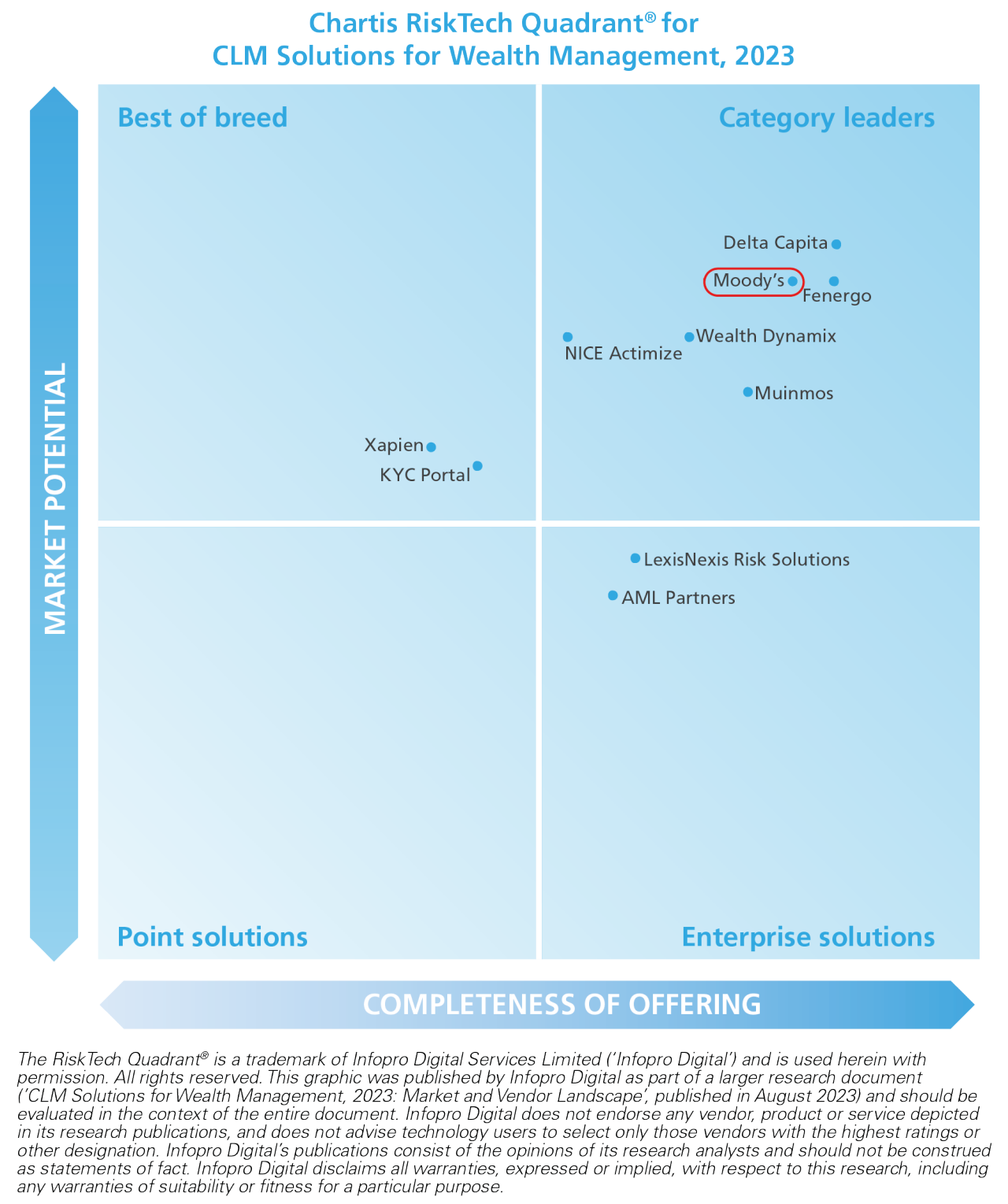

Chartis RiskTech Quadrant® category leader

CLM solutions for wealth management, 2023

Chartis Research positioned Moody's as a category leader in their report on CLM solutions for wealth management for 2023. The report comprehensively reviews the current market, highlighting the specific challenges of CLM for wealth management firms, and highlights vendor capabilities in the space. Moody's position highlights our completeness of offering and market potential.

Get in touch

Request a demo

We would love to show you what Moody's KYC can do! Get a demo or alternatively, keep reading to discover more about how Moody's KYC can help you.